Strikes on CPC Leave Western Energy Firm With Two Options — Pressure Kyiv or Diversify Routes

From November until mid-January, Kazakhstan reduced its oil exports to Europe by 3.8 million tons. A total of 60 million tons are exported annually via the CPC, which is a 6.3% decline. This is a direct consequence of Ukrainian attacks on the infrastructure of the Caspian Pipeline Consortium (CPC). More than 80% of Kazakhstan’s oil exports pass through the CPC.

The lost volumes are now being redirected through alternative routes. The largest of these is via Baku for further delivery to European markets. In 2025, 1.3 million tonnes of Kazakh oil were exported through the BTC pipeline, but this is a drop in the ocean. The attacks on the CPC have become an immediate trigger for the increased use of the Chinese route and the first direct shipments of Kashagan oil to China.

In the current situation, continued attacks will force Kazakhstan to reduce its oil exports to Europe and seek alternative routes, including to China.

5 Key Takeaways for Business

- CPC is not a “reliable baseline route” as long as Ukraine is conducting strikes.

Infrastructure risk has become structural rather than temporary. If the West and Western shareholders do not exert influence over Ukraine, then supply planning via the CPC should factor in regular disruptions and unplanned downtime. - The cost of risk has increased — and it is being borne by companies.

Losses from downtime, freight, penalties, and cargo rerouting will systematically raise costs for producers, traders, and buyers of Kazakh oil. The attacks have already inflicted significant damage on Kazakhstan’s budget. - Route diversification is becoming mandatory, not optional.

Oil consortia producing Kazakh oil and states dependent on these supplies must accelerate the development of alternative logistics chains (the Caspian route, the eastern direction), even if they are more expensive. - Infrastructure protection is becoming an investment priority.

The situation has reached a point where deploying air defense/electronic warfare systems and maritime protection along the CPC has become economically justified. Against the backdrop of budget losses in Kazakhstan, there is already serious discussion about installing such infrastructure. - Geopolitics is directly shaping commercial contracts.

The restrained reaction of Western shareholders in Tengiz, Karachaganak, and Kashagan to the attacks on CPC infrastructure underscores the relevance of revisiting field development terms in favor of Kazakhstan. Meanwhile, one of the reasons for transferring the “three giants” to Western companies in the 1990s was confidence in their strong lobbying capabilities — and, consequently, in their ability to guarantee uninterrupted oil production and exports from Kazakhstan.

Three Scenarios (2025–2027)

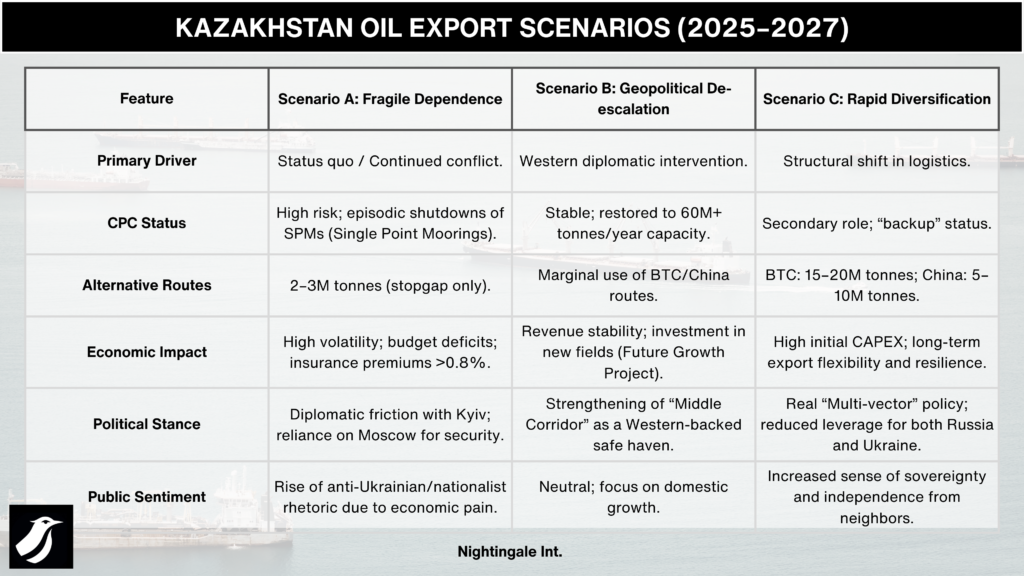

Based on our analysis of regional energy security and evolving geopolitical risks, we have developed three strategic scenarios for Kazakhstan’s oil exports through 2027. The following table compares these pathways, outlining the specific indicators and long-term consequences to help visualize the shift from dependence toward diversification.

Comparative Table: Kazakhstan Oil Export Scenarios (2025–2027)

Scenario A — “Fragile Dependence” (Baseline)

Attacks continue episodically; the CPC operates with disruptions.

Indicators:

- New incidents in the Black Sea

- Delays in repairing SPMs (Single Point Moorings)

- Rising insurance premiums for tanker shipping

Consequences:

- Volatility in Kazakhstan’s export revenues

- Pressure on the budget and investment climate

- Growing doubts among European buyers

- Gradual rise of anti-Ukrainian narratives in Kazakhstan

Scenario B — “Washington and Brussels Persuade Kyiv to ‘Leave CPC Alone’”

Kyiv removes the CPC from its list of priority targets. Europe continues to increase imports of Kazakh oil, strengthening its energy security. International consortia restore production levels in Western Kazakhstan.

Indicators:

- Cessation of Ukrainian attacks on the CPC

- Shift in public rhetoric by key stakeholders regarding the CPC

- Market reaction: reduction in tanker freight insurance costs

Consequences:

- Stabilization of CPC operations

- Strengthened European energy security

- Production ramp-up by the “three giants” consortia

- Signs of stabilization in Astana–Kyiv relations

Scenario C — “Supply Diversification”

Kazakhstan rapidly develops alternative routes.

Western route (Caspian → Baku → BTC):

- Expansion of the tanker fleet

- New port facilities and backup storage

- Utilization of underused BTC capacity (up to 30 million tonnes)

Eastern route (Atasu–Alashankou → China):

- Redirection of part of export volumes eastward

- Correction of the imbalance in which the pipeline crossing Kazakhstan primarily serves Russian exports to China

Indicators:

- Growth in BTC volumes (from the current ~1.6 million t/year)

- Increase in exports to China

- New investments in Caspian logistics

Consequences:

- Reduced critical dependence on the CPC

- Greater flexibility between the EU, Russia, and China

- Real substance to Kazakhstan’s multi-vector policy

The Lack of Energy Infrastructure Protection Raises the Question of Revising Ownership Shares

Despite all sympathy for Ukrainian society, Kazakhstan cannot and should not tolerate actions that cause direct damage to its economic interests. If international shareholders of Kazakh oil projects — primarily American and European companies — are unable to use their political influence to protect the infrastructure that secures their own assets, this legitimately raises the question of revising the balance of ownership stakes in field development.

In the context of growing instability and weak political support from the countries of origin of investors, it appears logical to strengthen the role of KazMunayGas and attract alternative partners, including companies from China and the Middle East.

Against the backdrop of regular attacks, some experts have begun to call on CPC shareholders to invest in infrastructure protection, including air defense and electronic warfare systems. Losses from Ukrainian drone attacks have already many times exceeded the cost of even the most expensive air defense systems, which means this is economically justified.

At the same time, it is obvious that Kazakhstan, as a neutral state, cannot unilaterally proceed with deploying air defense in the Black Sea. This would create a dangerous precedent and would look like indirect involvement in the conflict. Therefore, it is logical that responsibility should lie with the consortium and its international shareholders, who are losing money no less than Kazakhstan.

Attacks on the CPC Indicate the Need to Develop Alternative Routes

In Kazakhstan, there is increasing discussion about the need to accelerate the development of the Caspian direction. Expanding the tanker fleet, port transshipment capacity, and backup storage along the Caspian coast would make it possible to utilize up to 30 million tonnes of underloaded capacity of the Baku–Tbilisi–Ceyhan (BTC) oil pipeline and reduce critical dependence on the CPC. However, so far the scale remains symbolic. In 2026, 1.6 million tonnes of oil are planned for transshipment via the BTC route — a volume that the CPC pumps in less than two weeks.

Additionally, part of the volumes should logically be redirected eastward. The Atasu–Alashankou pipeline has significant spare capacity. Moreover, refineries in western China risk becoming underutilized in the medium term. In 2024, about 1 million tonnes of Kazakh oil were exported via this pipeline, while shipments of Russian oil exceeded 10 million tonnes. In effect, the pipeline running through Kazakhstan’s territory currently serves another country’s exports more than Kazakhstan’s own national interests.

All of this suggests that Kazakhstan has options for diversification, but none of them can replace the CPC in the short term. In these circumstances, the passive position of Kazakhstan’s partners looks unserious. The involvement of European states and oil majors in solving this problem is directly linked to Europe’s energy security amid growing geopolitical risks.

Ukraine Strikes Russia, but Kazakhstan and the European Union Are at Risk

Since February 2025, CPC infrastructure has become a regular target of Ukrainian drone attacks. In less than a year, 8 attacks have been recorded. Strikes have targeted pumping stations, the marine terminal, the office, and even Greek tankers transporting oil from the CPC. Formally, Kyiv frames these actions as part of a broader campaign of strikes against Russian oil facilities, citing the right to self-defense.

However, the CPC is primarily a channel for exporting Kazakh oil produced by international consortia. For Moscow, losses from strikes on the CPC are insignificant, while Astana and the international consortia operating in the country are losing billions. Moreover, the paradox of the situation is that the main buyers of Kazakh oil remain EU countries — Kyiv’s allies — whose energy security is also being put at risk.

Whether this was a conscious disregard of Kazakh interests by Kyiv or a result of underestimating how the CPC actually functions is difficult to assert.

The Consequences of the November Strikes Are Still Being Felt

The most painful blow to Kazakh oil exports was the attack on November 29, 2025. Early in the morning, unmanned surface vessels attacked the CPC marine terminal, as a result of which Single Point Mooring No. 2 (SPM-2) sustained critical damage. The consortium’s operational design assumes the simultaneous operation of two SPMs, while a third is kept in reserve. However, the strike on SPM-2 occurred at a time when SPM-3 was undergoing scheduled maintenance, leaving the terminal with only one operational SPM and sharply reducing its throughput capacity.

“The single point mooring is a key infrastructure element through which oil is directly loaded onto tankers.”

As a result, Kazakh oil exports found themselves in a “bottleneck,” and domestic production had to be reduced. Today, SPM-2 is partially submerged. Repairs are complicated by internal sea currents. According to available information, Kazakhstan is purchasing two new SPMs in the UAE. The devices have already been manufactured, and their delivery time is approximately 30 days. After arrival, about 40 days will be needed for installation. Thus, the total time for installing the two new SPMs will be around 70 days.

Chronology of Attacks on Caspian Pipeline Consortium Infrastructure (2025–2026)

| Date | Incident |

| 17 Feb 2025 | Kropotkinskaya Pump Station — attack by seven UAVs; the CPC’s largest pumping station was taken out of operation, throughput reduced; repairs took several months |

| 19 Mar 2025 | Kavkazskaya Pump Station — UAV attack on an oil transshipment facility |

| 24 Mar 2025 | Area near Kropotkinskaya PS / Kavkazskaya railway station — attempted UAV attack; air defenses intercepted the drones, debris fell near rail infrastructure |

| 24 Sep 2025 | Novorossiysk (CPC-R office) — UAV strike on the city; CPC office damaged, civilians injured; office operations temporarily suspended |

| 24 Sep 2025 | CPC Marine Terminal / Yuzhnaya Ozereyevka — combined attack by UAVs and unmanned surface vessels; tanker loading halted, vessels moved to anchorage |

| 25 Nov 2025 | CPC Marine Terminal (Yuzhnaya Ozereyevka) — night-time drone attack; terminal building damaged, operations temporarily suspended |

| 29 Nov 2025 | SPM-2 (Single Point Mooring-2), CPC Marine Terminal — strike disabled one offshore loading unit; terminal continues operating below design capacity |

| 15 Jan 2026 | Black Sea waters — UAV attacks on two Greek oil tankers, one chartered by Chevron |

At Nightingale Int., we support companies operating across Eurasia in understanding geopolitical risks before they turn into operational threats. We translate political instability, sanctions dynamics, and security shifts into clear, actionable intelligence for business decision-makers. Companies can contact us directly via our form: https://nightingale-int.com/contact-us/ .