Kazakhstan’s Profitable Tungsten Turn Strengthens China and the U.S.

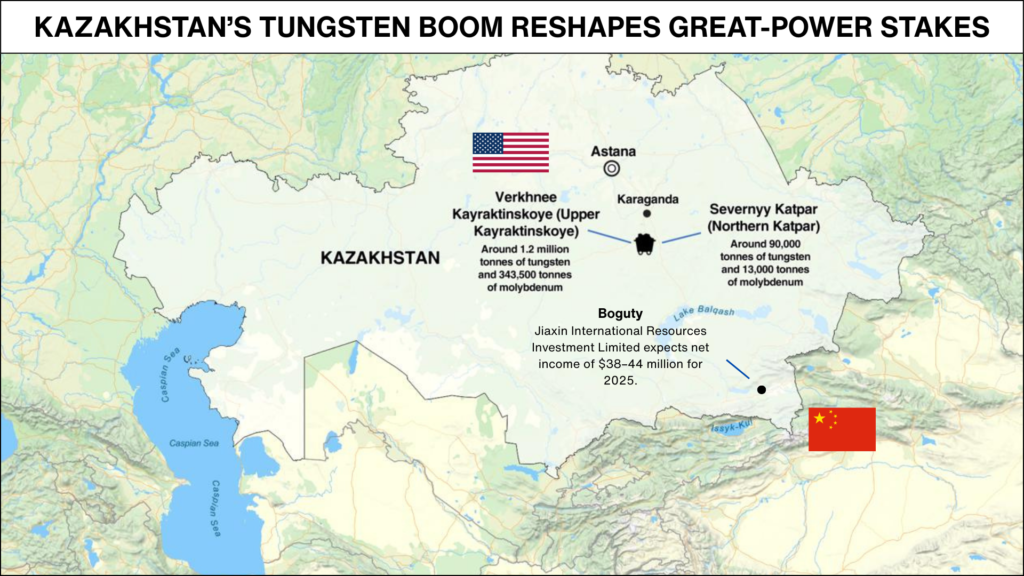

Kazakhstan’s tungsten sector has crossed a major commercial threshold: production is no longer merely prospective but demonstrably profitable. The rapid turnaround of Jiaxin International Resources Investment Limited – moving from a $22 million loss in 2024 to an expected $38–44 million profit in 2025 following the launch of commercial mining at the Boguty deposit – signals that Kazakhstan is no longer just a reserve holder of strategic minerals but an active, cash-generating player in the global tungsten market.

This shift is already reflected in capital markets, with Jiaxin’s share price surging more than eightfold since its IPO and the company’s valuation reaching approximately $4.8 billion. Rather than closing the chapter on great-power competition over Kazakhstan’s tungsten, this profitability is sharpening it: Beijing’s position is reinforced in the short term, while Washington’s rationale for a strategic entry becomes stronger, not weaker.

The Scenarios (Stress-Testing the Future)

Scenario A: The “Gravity Well” (Chinese Consolidation)

- The Narrative: Despite U.S. interest in Upper Kairakty, China’s existing processing plants and established rail links to Xinjiang create an “economic gravity” that the U.S. cannot break. The U.S.-backed projects are eventually sold or subcontracted to Chinese firms because the “Time to Market” for a Western route is too slow.

- Business Impact: Supply Chain teams should assume China maintains its 80%+ global monopoly.

- Indicator: Failure of the “Middle Corridor” (Trans-Caspian) to secure heavy-freight mineral capacity by 2027.

Scenario B: The “Bifurcated Corridor” (Successful Multi-alignment)

- The Narrative: Kazakhstan successfully plays both sides. It allows China to dominate the Boguty deposit while giving the U.S. (Cove Capital) “Sovereign Guarantees” for a parallel, Western-aligned supply chain. Kazakhstan becomes the “Tungsten Laundromat” where the world’s supply is balanced.

- Business Impact: “Middle Power” leverage increases. Costs rise for both the US and China as they compete for Kazakh labor and engineering talent.

- Indicator: A Western “Off-take” agreement is signed that specifically prohibits Chinese equity in the processing phase.

Scenario C: “Resource Sovereignty” (The Kazakh Pivot)

- The Narrative: Seeing the profitability of Jiaxin, the Kazakh government (via Tau-Ken Samruk) mandates that all tungsten must be processed into value-added products (like tungsten carbide) inside Kazakhstan before export.

- Business Impact: Shift from “Extractive Industry” to “Industrial Development.” High-tech firms must now build factories in Kazakhstan, not just buy ore.

- Indicator: New Kazakh labor or export laws requiring 50%+ local “value-add” on critical minerals.

Perceptive vs. Objective Geopolitics

- Perceptive (Washington/Beijing): Washington perceives this as a zero-sum race to stop Chinese hegemony. Beijing perceives this as a natural extension of its “Belt and Road” geography.

- Objective (The Reality): Regardless of who “owns” the mine, the Logistics are the bottleneck. If the U.S. wants Kazakh tungsten, it doesn’t just need a mine; it needs a fleet of ships in the Caspian Sea and a rail deal with Georgia/Azerbaijan. Without this, the U.S. project is “objectively” just a secondary supplier for China.

Commercial Proof of Viability Lowers Risk and Raises the Stakes

The success of the Boguty project functions as a real-world stress test for Kazakhstan’s tungsten geology, infrastructure, and regulatory environment. For investors, the fact that a large-scale project could move from preparation to profitable production within a relatively short timeframe undermines long-standing perceptions that Kazakh mining projects are structurally slow, capital-heavy, or excessively risky.

This is particularly relevant for Western financial institutions that may be involved in the U.S.–Kazakhstan tungsten partnership, such as development finance bodies or export credit agencies. The profitability of Jiaxin does not directly affect the planned U.S. deal at Upper Kairakty and North Katpar, which are separate deposits with different ownership structures, but it creates a more favorable investment narrative around the sector as a whole.

At the same time, this proof of viability raises the strategic stakes. As Kazakhstan demonstrates its capacity to monetize tungsten efficiently, the country becomes an even more valuable prize in the global race for critical minerals. This increases competitive pressure among external actors and elevates tungsten from a purely commercial commodity to a core element of Kazakhstan’s geopolitical bargaining power. In other words, profitability further politicizes the sector.

China’s Short-Term Advantage Deepens While the U.S. Case Strengthens in the Long Run

Jiaxin’s success also underscores China’s entrenched position in Kazakhstan’s tungsten value chain. The company’s processing plant in Almaty region, with a capacity of 3.3 million tons of ore per year, anchors Chinese influence not just in extraction but in beneficiation and downstream processing.

The fact that 99.98% of Kazakhstan’s tungsten ores and concentrates currently flow to China illustrates how deeply integrated Astana already is into Beijing’s industrial ecosystem. As Jiaxin becomes more profitable, China’s economic leverage in the sector is likely to expand further through reinvestment, logistics control, and long-term offtake relationships.

Paradoxically, this very consolidation of Chinese influence makes the U.S. tungsten initiative more strategically compelling. From Washington’s perspective, the profitability of Chinese-linked projects in Kazakhstan highlights the urgency of creating an alternative supply corridor that is aligned with U.S. and allied defense and industrial needs.

The Cove Capital–Tau-Ken Samruk partnership is therefore less about competing with Jiaxin in the near term and more about constructing a parallel, non-Chinese production base that can gradually rebalance the global market.

For Kazakhstan, this dynamic creates leverage but also complexity. Rising Chinese dominance strengthens Astana’s negotiating hand with Washington, but it also heightens expectations that any U.S.-backed project will meet stricter standards on transparency, governance, and export alignment with Western supply chains. Profitability gives Kazakhstan leverage to court both China and the U.S., but it also forces Astana to manage competing demands over governance and export destination.

Actionable Business Takeaways

- For the CEO/Investor: Don’t look at Jiaxin’s stock price as a reason to buy Jiaxin. Look at it as a “Stress Test” that proves the Kazakh government can and will support profitable mining. The risk of “Geological Failure” is now replaced by “Logistical/Political Risk.”

- For the Supply Chain Manager: If your company relies on tungsten for semiconductors or aerospace, you must move your “Time to Decision” on diversifying away from 100% Chinese-processed material. Kazakhstan is your one of the viable alternative, but you must invest in the U.S.-aligned corridor now to have supply by 2028.

- The Strategy-Foresight Bridge: Use the “Boguty Success” as the data point to convince the Board that Kazakhstan is no longer a “frontier” market but an “emerging core” market.

At Nightingale Int., we support companies operating across Eurasia in understanding geopolitical risks before they turn into operational threats. We translate political instability, sanctions dynamics, and security shifts into clear, actionable intelligence for business decision-makers. Companies can contact us directly via our form: https://nightingale-int.com/contact-us/ .