The Dangerous Knockdown of Europe’s Most Critical Energy Partner

Tengiz is in flames and the CPC is under attack. These events threaten the oil giant supplying 12 percent of Europe and risk a major economic knockdown.

On January 18, a fire broke out at the gas turbine power plant equipment of the Tengiz field, forcing the operator, Tengizchevroil (TCO), to temporarily suspend oil production. This incident should be viewed not merely as a local accident, but as a “knockdown” for one of the key pillars of the Kazakh economy, with consequences extending far beyond a single company.

Tengiz Is One of the Largest Oil Fields in the World

In 2024, it accounted for approximately 32% of all oil production in Kazakhstan, and TCO itself provided 6.57% of all tax revenues in the republic, more than any other company. This means that any stoppage at Tengiz directly impacts the national budget, export earnings, and the country’s balance of payments.

Ranking of Kazakhstan’s Largest Corporate Taxpayers in 2025 (based on Adata service, as of 21 January 2026)

| # | Company | Region | Sector | Share of Total Tax Revenues |

| 1 | Tengizchevroil LLP | Atyrau | Oil & Gas | 6.57% |

| 2 | Karachaganak Petroleum Operating B.V. | West Kazakhstan | Oil & Gas | 1.83% |

| 3 | Holding Group ALMEX | Almaty City | Investments | 0.67% |

| 4 | Halyk Bank | Almaty City | Banking | 0.60% |

| 5 | KAZ Minerals Aktogay | Abai | Mining | 0.59% |

According to expert estimates, daily production at Tengiz in recent years has exceeded 600,000–650,000 barrels per day, reaching 900,000 barrels during peak periods. If Reuters’ reports of a possible 10-day suspension at Tengiz are confirmed, TCO’s losses could amount to up to 6 million barrels of oil.

At current prices, this is equivalent to approximately $380–390 million in lost export revenue. Fiscal losses for Kazakhstan will be lower and depend on the terms of the Production Sharing Agreement (PSA); however, even then, we are talking about tens of millions of dollars and additional pressure on the budget.

“Shooting at Russia, Hitting Kazakhstan”

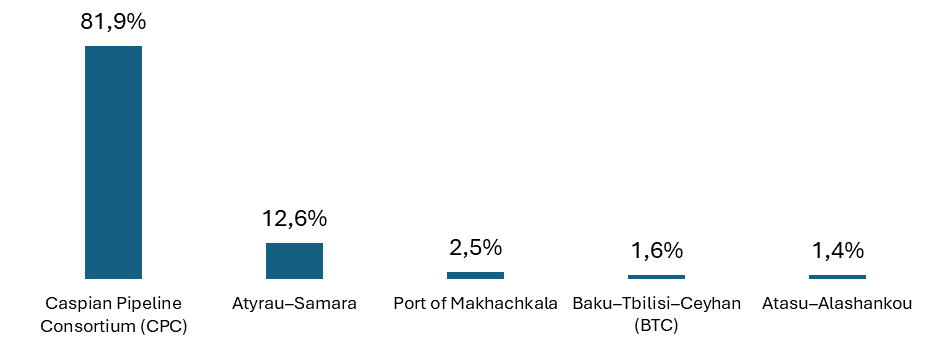

The situation surrounding Kazakh oil is exacerbated by Ukrainian drone attacks on the infrastructure of the Caspian Pipeline Consortium (CPC). Recent drone strikes targeted the Single Point Moorings (SPM) of the CPC marine terminal near Novorossiysk. These are key infrastructure elements through which oil is loaded directly onto tankers. Damage to even one SPM automatically reduces the terminal’s throughput capacity, and in the event of repeated strikes, the CPC effectively operates at “half strength.”

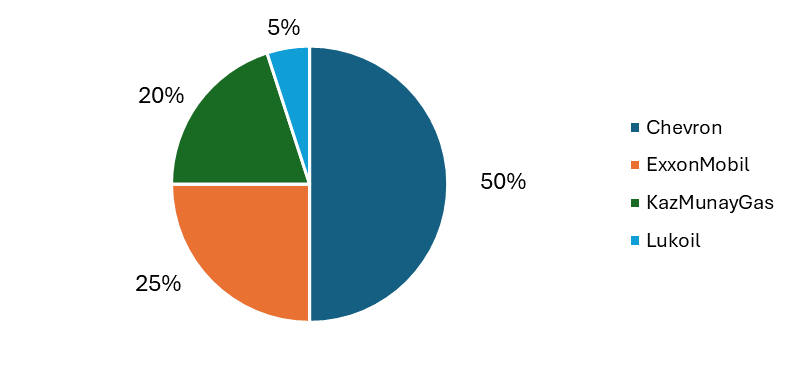

Approximately 82% of Kazakh oil exports pass through the CPC, consisting of oil from fields developed by consortia involving Chevron, ExxonMobil, Eni, Shell, and TotalEnergies. For the West, this is not “someone else’s pipe.” It is a channel that ensures tens of billions of dollars in export revenue, a significant share of Kazakhstan’s budget income, and stable oil supplies to European markets. By the end of 2024, Kazakhstan became one of the top three oil suppliers to the EU, providing about 11.5% of European imports. Any reduction in supplies directly affects the EU’s energy stability and increases market sensitivity to disruptions at Kazakh fields.

Attacks on the CPC Hit the Interests of Western Companies

The Ministry of Foreign Affairs of Kazakhstan officially classified the attacks on CPC facilities as an act of aggression against critical civilian infrastructure and sent a note of protest to Ukraine, demanding the prevention of similar incidents in the future.

Astana emphasizes that the CPC operates within the framework of international law and ensures the supply of Kazakh oil to world markets, and its disruption undermines the energy security of several countries. Meanwhile, Kazakhstan has consistently advocated for the territorial integrity of Ukraine and became the only Central Asian country to officially send it humanitarian aid.

Against this backdrop, the passive stance of Western countries appears to be a reluctance to notice the obvious. Attacks on the CPC are presented as an element of the war with Russia, but in practice, they hit Kazakhstan and the interests of Western companies. Even with a complete shutdown of the CPC, Moscow’s losses are limited to hundreds of millions of dollars a year, sensitive, but comparable to a “mosquito bite.” For Kazakhstan, however, this involves billions of dollars in lost revenue and rising socio-economic risks.

Ignoring these attacks looks like silent consent to the damage suffered by Kazakhstan and Western investors. In such a situation, it would be logical for the US and the EU to move toward a direct dialogue with Kyiv regarding the inadmissibility of strikes on critical civilian infrastructure that ensures Europe’s energy security.